It has been swings and roundabouts in the housing market over the last decade or so. Go back to 2006 and times were good.

House prices were booming, and the economy appeared to be soaring. Then in 2008, that world started to come crashing down. Everybody realized that the whole thing was one giant

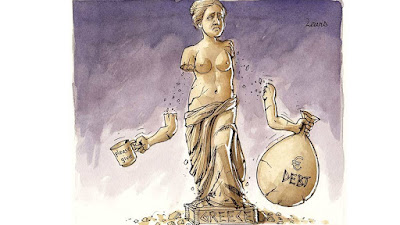

debt bubble, waiting to pop. Since then, the government has pumped a load of money into the system, and things are ticking along nicely again. But some people see trouble ahead.

Moody’s, for instance, has said that the market will suffer over the next few years unless more first-time buyers enter the market. We’re at risk, according to the agency, of having a situation where supply outstrips demand. Back in 2014, the number of new home buyers on the market reached a record low. Without this demand, there’s a risk that home prices could come crashing down once again.

As a result, it seems like it’s impossible for the housing market to reach a happy medium. It’s either in a bubble, waiting to burst, or in the depths of a recession. So what does it all mean for you?

It could mean that it’s a good time to think about buying a new house. If home prices are going to fall again, it’s worth thinking about putting your home up on the market now to get ahead of the curve. You can sell now and then buy again in the future when prices have tanked, netting yourself a big chunk of equity.

The problem is that many people get into trouble when buying a new home. They make mistakes, and these mistakes end u p costing them. Often people get into the habit of

rationalizing larger purchases that they cannot possibly afford. They think to themselves that it’s worth spending an extra $40,000 on a home if it has a slightly better location. And they don’t realize how at odds this type of thinking is with the rest of their behavior. It might sound like a nice idea, but since when has living a mile or two closer to work been worth $40,000?

Buying a house is exciting. But buyers frequently make mistakes. Here are some of the most egregious.

Mistake Number 1: Being Naive About The Home You’re Buying

Many new home buyers push their finances to the limit when buying a new home. They want something nice, and they are prepared to max out their finances to pay for it.

But there’s a problem with this strategy. Most homes aren’t brand new. As a result, many have problems that buyers don’t always see immediately. Buyers think that they can afford a house based on the mortgage repayments, but they don’t

factor in other running costs. It’s unlikely, for example, that the house you buy will be entirely without problems. Most houses have at least something wrong with them, even if it is not immediately apparent. Buyers are usually okay for a few months. But then problems come in when something goes seriously wrong with the house, and they need to fix it.

This problem is often much worse the older the house is. Older homes often need to have the wiring redone,

damp removed and have

new roofs installed. These costs can add up and often make the home unaffordable.

Other homeowners aren’t naive about the home, they’re naive about the neighborhood. Often, homebuyers will see a house on the market that looks like a bargain. They go to visit the house, and sure enough, it’s in excellent condition. The only problem is that it is in a neighborhood, notorious for crime. Buyers often forget that it is easy to fix up a house but a lot harder to fix up a neighborhood. As the reality of life in a dangerous community sets in, many buyers end up wishing they’d never moved. It’s worth noting, therefore, that houses are only ever as good as the surrounding environment. Location matters.

Mistake Number 2: Not Protecting Yourself With Contingency Clauses

House sellers are getting very savvy these days. They know how to present a house to potential buyers to make it more attractive and fetch a higher price. There’s advice all over the internet on how to do it, as well as companies who offer bespoke curb appeal services.

For buyers, all of this is bad news. Buyers are bamboozled and wowed into thinking the homes they’re looking around are better than they actually are.

This is why it’s such a good idea to get protection before you buy a property. One form of protection is to hire a professional inspector. Inspectors are trained to find problems that aren’t immediately visible to the untrained eye. They look out for things like misaligned kitchen counters and problems with the waterworks. They’re also trained to look for damp and mold in the basement and whether the foundations are secure. Sellers are unlikely to divulge this information because they know how damaging it can be for making the sale. The number one thing that people don’t want from a new home is

mold growing on the walls.

The other form of protection buyers can get is contingency protection. Contingency protection is a way of protecting yourself against mortgage repayments if you lose your job. It’s also a way of recovering the costs of buying a home of the loan falls through. Without having this clause, buyers can lose their money and still have to purchase the house.

Mistake Number 3: Failing To Factor In Additional Costs

Most people

rent a home before buying their own. As a result, they’re used to paying a single, upfront payment - the rent. Their landlord deals with all the other ancillary costs. But for people who buy their own houses, the situation is different. They have to pay for all the other expenses that come along with home ownership.

Take homeowner insurance, for instance. Homeowner insurance rates differ depending on where you live. In Florida, thanks to geographic factors, they’re high at around $161 a month. In Wisconsin, on the other hand, they’re much lower, coming it at around $50.

Property taxes vary by region too. Property taxes are notoriously high in places like New Jersey, Texas and Wisconsin. But they’re much lower in places like Hawaii, Louisiana, and Alabama.

There are also additional costs that you have to pay, depending on your deposit. If your deposit was less than 20 percent of the value of the home, you have to pay what’s called “private mortgage insurance.” This insurance guarantees the mortgage lender will still get payments, even if you default on your loan.

All of this means that paying for a mortgage is often very much more expensive than the monthly loan repayment amount. A typical $750 mortgage can often end up costing more than $1,100 all told.

Mistake Number 4: Basing Your Mortgage On Your Future Income

A lot of so-called experts recommend that people take out expensive mortgages today because they’ll be able to afford them in the future. The idea is that over time, you’ll get promoted,

earn more and be in a better position to afford the loan. But there’s a problem with this approach. Wages across the US for the average family aren’t going up. For every person who gets a promotion and a bigger paycheck, somebody else is falling behind.

Now many advisors are changing their approach. They want to see people take out loans that they can afford today. If they’ve got a good credit score, great - they can take out bigger loans. But it shouldn’t be the norm for everybody.

Learn from California Mortgage Advisors more about which types of loans are available.

Mistake Number 5: Failing To Use Online Mortgage Calculator Tools

Right now, there are a host of online tools that will automatically calculate your mortgage repayments. These calculations are based on the rate of interest, loan repayment amount and the time horizon over which you will repay. They’re an excellent way to find out exactly how much you can expect to pay at the end of the month.

Many homebuyers, however, don’t use these tools. Instead, they “guesstimate” how much they’ll have to repay on a mortgage and make decisions based on that.

One of the ways you can gauge whether you can afford a new mortgage is to look at what you’re paying right not on rent. If you’re just scraping by paying a $600 rent, it’s probably a bad idea to take out a $800 mortgage. Similarly, if you’re doing great with a $600 rent, there’s nothing to stop you from buying a house with a $1000 mortgage.

Bear in mind that it’s always worth leaning towards a mortgage payment that is lower than your rent. As we’ve discussed, when you own your own place, you have to pay for additional, unforeseen costs. Figure out how much money you have to play with before starting on your own house hunt.